FAQs About Offshore Trusts Every Investor Should Read

FAQs About Offshore Trusts Every Investor Should Read

Blog Article

Why Individuals and Organizations Think about an Offshore Depend On for Tax Effectiveness

Numerous people and companies turn to overseas depends on as a method for tax performance. These counts on offer distinct benefits, such as potential deferment of income tax obligations and reduced rates in desirable jurisdictions. By positioning assets within these depends on, customers can successfully decrease funding gains and inheritance tax obligations. The benefits extend beyond simply tax obligation cost savings. Recognizing the more comprehensive effects of overseas depends on exposes a complex financial landscape that values better expedition.

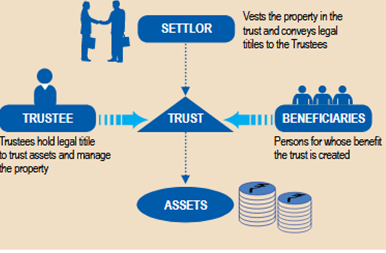

Comprehending Offshore Trusts: Interpretation and Purpose

Offshore counts on serve as specialized monetary instruments developed to manage and safeguard properties while maximizing tax obligation efficiency. These lawful frameworks are developed in territories outside the person's country of residence, commonly offering positive tax regimes and personal privacy protections. The key purpose of an overseas trust is to segregate properties from the person's individual estate, therefore assisting in critical monetary preparation. By putting possessions in a count on, individuals can possibly lower their total tax obligation worry while making certain that their wide range is protected for future generations. Furthermore, overseas counts on offer flexibility concerning property monitoring and circulation, enabling trustees to adapt to changing scenarios. They can be particularly helpful for high-net-worth people and families looking for to guard their wealth versus possible risks, such as market volatility or legal obstacles. Eventually, understanding offshore counts on is important for anyone considering them as a device for tax performance.

Benefits of Offshore Trust Funds for Possession Defense

One significant advantage of using trust funds developed in foreign territories hinges on their capability to give robust possession security. Offshore trusts are commonly structured to shield possessions from possible creditors or legal claims, producing a barrier that can prevent claims and financial liabilities. This security is specifically valuable for individuals in high-risk careers or company proprietors encountering litigation.Additionally, the legal frameworks of numerous offshore territories supply beneficial conditions, consisting of solid personal privacy regulations that safeguard the identity of depend on recipients and their properties. This discretion can additionally enhance protection versus undesirable scrutiny. The splitting up of assets from personal holdings implies that, in the event of personal bankruptcy or divorce, the possessions within the overseas trust are much less at risk to being seized. Overall, the critical facility of offshore counts on functions as a beneficial device for those seeking to protect their riches from unexpected threats.

Tax obligation Performance: How Offshore Trusts Decrease Tax Responsibilities

Offshore counts on offer significant tax obligation advantages that can help services and individuals reduce their tax responsibilities. By strategically putting assets in these depends on, one can additionally boost asset defense methods, protecting wide range from potential lenders and lawful challenges. Comprehending these mechanisms is essential for making the most of economic effectiveness and safety and security.

Tax Obligation Advantages Overview

While lots of people seek means to maximize their monetary methods, using overseas trusts has arised as a compelling choice for reducing tax obligation liabilities. Offshore depends on supply several tax advantages that can significantly boost economic performance. One main benefit is the possibility for tax deferral, allowing individuals to delay tax obligation settlements on income produced within the depend on till it is distributed. Furthermore, these depends on might give accessibility to lower tax prices or exceptions in particular territories, additionally minimizing overall tax burdens. By purposefully positioning properties in an offshore count on, individuals and businesses can take advantage of positive tax laws to make best use of wide range conservation. Inevitably, the tax obligation advantages of overseas trust funds make them an eye-catching selection for those aiming to enhance financial end results.

Property Defense Methods

Using overseas depends on not only supplies substantial tax advantages yet likewise functions as a robust strategy for property security. These counts on can protect assets from prospective financial institutions, lawful insurance claims, and unanticipated monetary challenges. By positioning possessions in an overseas trust fund, people and services can produce a barrier versus domestic suits and claims, making it extra tough for creditors to accessibility these sources. Additionally, the discretion linked with overseas trusts can further improve protection, as it restricts public understanding of possession holdings. Expanding properties across territories likewise mitigates risks related to financial instability in any solitary nation. Overall, offshore depends on represent a tactical technique to guarding wide range while concurrently enhancing tax obligation effectiveness.

Estate Preparation and Succession: The Function of Offshore Trusts

Estate planning and sequence are essential parts of monetary administration, especially for individuals with substantial possessions. Offshore trusts offer as a calculated tool in this process, enabling individuals to manage their riches throughout borders while ensuring a smooth transfer of possessions to recipients. By establishing an overseas trust fund, people can determine the terms of possession distribution, consequently lessening prospective disputes amongst heirs.Additionally, offshore trust funds can assist mitigate estate tax obligations, depending on the legal structures of the jurisdiction included. They give a structured strategy to managing wide range, guaranteeing that properties are protected and allocated according to the grantor's wishes. This is specifically advantageous for those with facility family dynamics or different property types, as the trust can accommodate certain guidelines regarding the administration and circulation of properties.

Personal privacy and Privacy: Guarding Your Financial Details

Regulative Considerations and Conformity Issues

While offshore trust funds supply significant personal privacy benefits, they additionally come with an intricate landscape of regulative factors to consider and compliance concerns that should be browsed very carefully. Jurisdictions that offer offshore trust funds usually have particular regulations governing their facility and management. As an example, the Foreign Account Tax Obligation Compliance Act (FATCA) mandates U.S. residents to disclose foreign economic assets, increasing conformity burdens for count on holders. In addition, numerous nations have applied anti-money laundering (AML) guidelines that require due diligence and openness in trust operations. Failure to comply with these policies can lead to severe penalties, including penalties and legal repercussions. It is crucial for individuals and businesses to engage lawful and economic specialists that know with both local and international laws to ensure compliance. While the benefits of offshore depends on are appealing, the connected regulative complexities necessitate careful planning and professional advice.

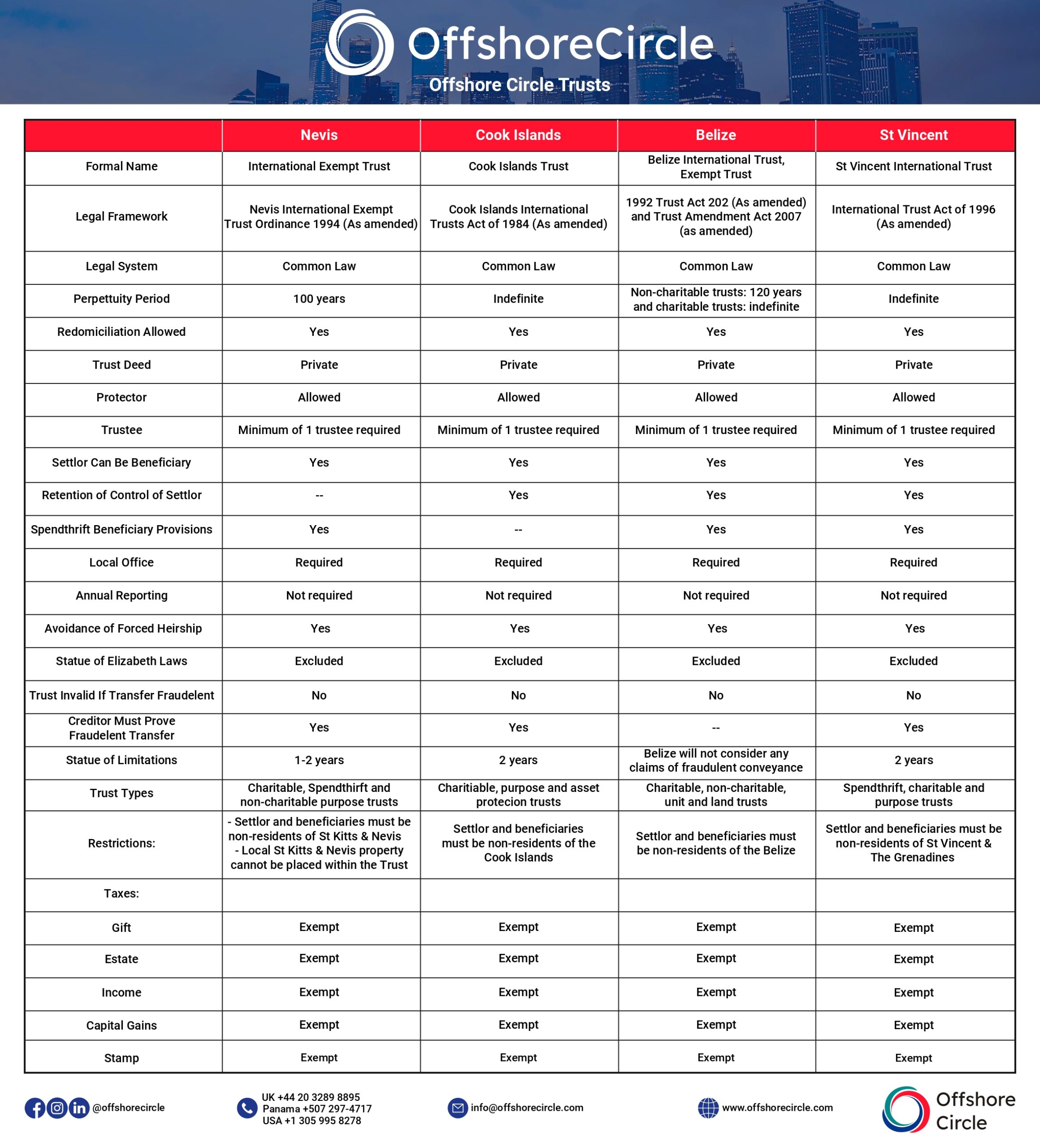

Picking the Right Offshore Jurisdiction for Your Count on

Selecting the ideal offshore jurisdiction for a count on involves careful factor to consider of the lawful structure's stability and the tax incentives offered. A jurisdiction with a reputable and robust lawful system can give higher protection and comfort for trust makers. In addition, comprehending the particular tax obligation advantages offered by various regions is essential for optimizing the depend on's efficiency.

Lawful Framework Security

Choosing the ideal offshore jurisdiction for a trust fund requires cautious consideration of the legal structure security, which considerably influences the trust fund's long-lasting efficiency and protection. A steady legal atmosphere ensures that the trust will certainly be secured versus arbitrary adjustments in legislations or guidelines that could weaken its function. Territories known for strong lawful practices, durable judicial systems, and adherence to worldwide treaties are usually favored, as they supply a feeling of integrity for count on inhabitants and recipients. In addition, clarity click this link in the legal framework helps in reducing the threat of disputes and improves depend on management. People and businesses need to carry out thorough research to determine jurisdictions that not only use stability however are likewise reliable and respected in worldwide monetary circles.

Tax Rewards Used

What tax rewards can improve the efficiency of an overseas trust? Different territories provide particular tax obligation advantages that can considerably boost the economic effectiveness of these depends on. For instance, some areas supply no or low capital gains tax obligations, permitting assets to expand without the worry of taxes up until they are distributed. Additionally, particular territories may excuse offshore trusts from inheritance or inheritance tax, making certain that riches is preserved for recipients. Other incentives consist of positive tax prices on income created within the count on or preferential therapy for foreign-sourced income. Clients ought to very carefully assess the tax motivations of prospective jurisdictions to straighten their economic objectives with the legal benefits offered, maximizing the overall advantages of their offshore trust plans.

Frequently Asked Concerns

Are Offshore Trusts Legal and Certified With Tax Regulations?

Offshore counts on are lawful entities that can abide by tax obligation regulations, offered they follow regulations in both the host country and the person's resident country. Their validity typically depends on particular circumstances and objectives.

Just how Do I Establish up an Offshore Trust?

To establish an offshore depend on, one should pick a territory, pick a trustee, fund the trust with possessions, prepare a count on act, and warranty compliance with lawful needs, including tax obligation responsibilities, in both home and offshore places. Offshore Trust.

What Are the Costs Connected With Preserving an Offshore Trust Fund?

Preserving an overseas trust entails Get the facts several costs, consisting of setup fees, yearly management charges, legal and bookkeeping costs, and possible tax on revenue. These expenses can differ considerably based on jurisdiction and the intricacy of the trust fund framework.

Can Offshore Trusts Protect Assets From Creditors?

Offshore counts on can potentially protect properties from financial institutions by putting them past the reach of residential lawful claims. The efficiency of this protection varies based on territory and certain legal circumstances surrounding each instance.

Just how Do I Select a Trustee for My Offshore Trust?

Picking a trustee for an offshore trust fund includes assessing their experience, credibility, and understanding of appropriate laws. It is crucial to ensure they possess honesty and a commitment to acting in the ideal rate of interests of the trust. Offshore trust funds offer as specialized financial tools made to handle and secure possessions while maximizing tax obligation effectiveness. Offshore trusts use significant tax obligation advantages that like it can assist individuals and organizations reduce their tax obligation obligations. By purposefully placing possessions in an overseas count on, companies and people can leverage positive tax obligation regulations to maximize riches preservation. By developing an offshore trust, individuals can determine the terms of property circulation, thereby minimizing prospective disagreements among heirs.Additionally, offshore counts on can assist minimize estate tax obligations, depending on the legal frameworks of the jurisdiction included. Selecting the appropriate offshore jurisdiction for a trust fund requires careful factor to consider of the lawful framework stability, which substantially impacts the trust's lasting performance and security.

Report this page